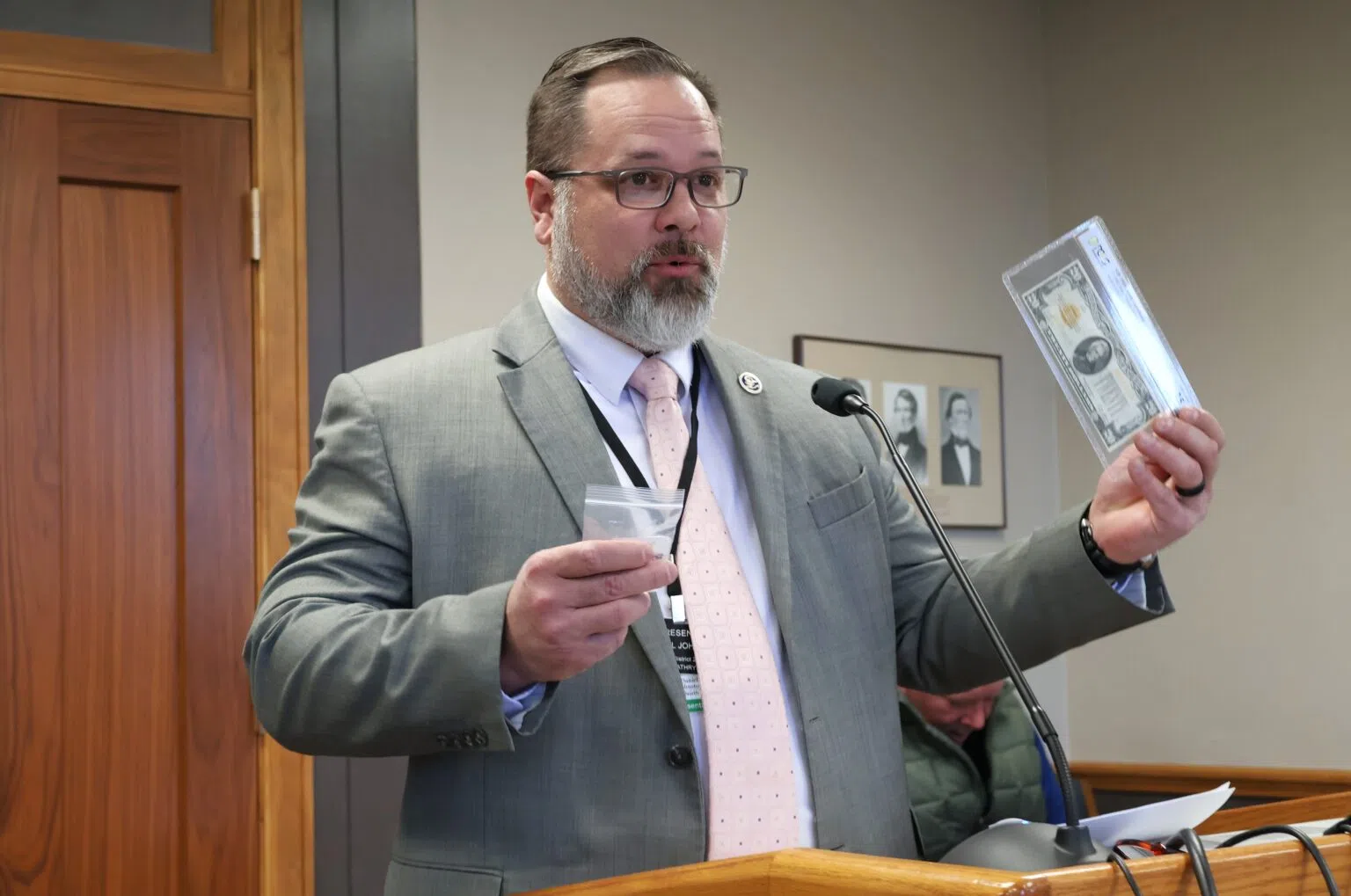

Rep. Daniel Johnston, R-Kathryn, holds up a $20 gold certificate and a gold coin during a committee hearing on March 10, 2025. (Michael Achterling/North Dakota Monitor)

By: Michael Achterling

BISMARCK, N.D. (North Dakota Monitor) – The North Dakota Legislature is considering investing 1% of the state’s treasury in gold and silver, something other states and nations have done to ensure financial stability.

Bill sponsor Rep. Daniel Johnston, R-Kathryn, told a legislative committee Monday that an investment that remains independent in value from the dollar would be beneficial in times of inflation or other financial pressures.

“Even in a good year, our dollar is losing 2% to 3% of its value,” Johnston told the Senate Industry and Business Committee.

His proposal, House Bill 1183, would require 1% of the state general fund and other funds managed by the state treasurer to be invested in gold or silver bullion or coins starting July 2027. A fiscal note estimates that to be about $40 million for 2027-29.

The bill only relates to funds managed by the state treasurer, not the Legacy Fund, Common Schools Trust Fund or other state funds managed by boards.

The bill also requires the treasurer to study the benefits of investing in gold and silver, with a report due by June 2026. The cost of the study is estimated at $50,000.

The bill passed the House last month on a 54-35 vote after initially failing by one vote.

Johnson said members of the BRICS nations, an informal association including Brazil, Russia, India, China and South Africa, among others, are moving away from using the U.S. dollar as foundational currency in favor of gold as the U.S. continues to accrue more debt.

“American consumer debt has never been higher,” Johnston said. “Nations around the world see this and are preparing themselves for the day that the dollar is no longer the reserve currency of the world.”

In an interview with the North Dakota Monitor, State Treasurer Thomas Beadle said his office wants to remain neutral in discussions about the bill. He said other states with similar statutes use precious metals with their “rainy day” funds and not their general funds because they need funds to remain accessible on short notice.

“I’m always hesitant anytime we do a specific asset allocation within Century Code, but I do think gold has been a strong investment for a number of years and I think it has a very rosy outlook into the future,” Beadle said.

The bill would require the treasurer to develop policies and procedures for managing the state’s precious metals stockpile and hold the gold or silver in a secure facility.

The state-owned Bank of North Dakota also is neutral on the bill but officials have pointed out it would add costs for renovations and additional security if the bank were to store precious metals.

“I think there’s quite a bit of thought out there that the bank could do that with a vault in the basement,” Bank of North Dakota President Don Morgan told the Industrial Commission last month. “There’s lots of logistics and security and insurance to consider.”

Kelvin Hullet, chief business development officer for the Bank of North Dakota, told lawmakers on Monday his team has taken preliminary steps to see if holding gold in the vault is feasible.

“It would probably take a couple million dollars in renovations to bring that up to speed to be able to store gold and silver,” Hullet said. He estimated that a $100 million in precious metals investment would require about $400,000 to $600,000 in annual operating costs.

The bill gives the state treasurer the ability to use a third-party contractor to assist with precious metals services, if needed.

Jp Cortez, executive director of the Sound Money Defense League, testified in favor of the bill. He told lawmakers Texas and Ohio already invest in gold and other states including Wyoming and Utah are adopting similar legislation.

The committee did not take immediate action after the hearing.

A similar bill, House Bill 1184, sponsored by Rep. Nathan Toman, R-Mandan, would have allowed up to 10% of the funds managed by the State Investment Board and the Board of University and School Lands to be used on precious metals or digital currency. That bill failed in the House on a 57-32 vote in January. Those boards already have that authority.

Comments