West Central Ag Services will move forward with a member vote on a proposed merger by the northwestern Minnesota cooperative with CHS Inc., a diversified global agribusiness co-op owned by farmers and member cooperatives across the United States.

“We believe that proceeding with the proposed transaction with CHS provides our member-owners with numerous benefits, such as global market access for both grain markets and inputs,” said West Central Ag Services Board Chairman Duane Brendemuhl, a Moorhead, Minn., farmer. “While we received and considered another proposal, we continue to believe that CHS is the right fit for us.”

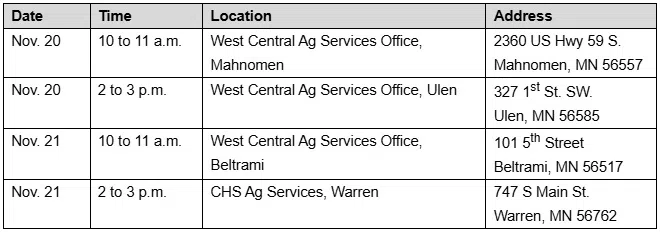

West Central patrons are slated to vote on a revised proposal from CHS at a Nov. 26, 2024, meeting. The proposal requires a two-thirds vote of members attending that meeting for approval. If approved, the transaction would close in the coming weeks.

West Central had previously scheduled a Nov. 7 member vote on a CHS proposal when it received a second unsolicited bid from The Arthur Companies (Arthur) on Nov. 4. Arthur had previously submitted an earlier bid in spring. At that time, the West Central Board concluded that a transaction with CHS was superior and a better fit and notified Arthur of its intent to move forward with CHS.

The proposed transaction with CHS was publicly announced on May 15, 2024. The West Central Board, with CHS in agreement, postponed a planned Nov. 7 vote in order to assess Arthur’s new proposal. The Board and West Central’s management then met with both Arthur and CHS on Nov. 14 and conducted a rigorous review of the merits of their respective proposals.

“During this process, the Board negotiated with CHS to increase the CHS base purchase price from $200 million to $225 million. This reflects CHS commitment to this transaction and the owners of West Central. CHS is willing and able to close a transaction with West Central in the coming weeks,” Brendemuhl said.

“After carefully considering Arthur’s revised proposal, as well as the information submitted by Arthur at West Central’s request, the Board concluded that the transaction with CHS continued to represent a superior proposal, and better met West Central’s and our patron growers’ long-term supply and market objectives. We continue to believe that CHS is the right home for us.”

He noted that the West Central Board discussed the materials provided by Arthur at length with its legal and financial advisors and concluded that there was a very high likelihood that Arthur may not be able to close a transaction with West Central at all, or if a closing occurred, it would be at a minimum three or four months out, versus an expected quicker closing with CHS.

“CHS offers certainty and near immediate completion. Arthur does not. We have a long history of successful relationships with CHS, as a member cooperative, a customer, a joint venture partner and an occasional competitor. ‘A bird in the hand’ is no small thing when it comes to transactions like this, and that is what we have with CHS,” Brendemuhl said.

As part of CHS, West Central members will continue to be a part of a cooperative, will be able to elect a local producer board and will have a voice, including through CHS Board of Directors’ elections and proposed changes to the CHS Articles of Incorporation and Bylaws. CHS is also retaining West Central’s employees and its management team.

“As a cooperative, our member-owners are the final decision makers. Our job as their elected board is to ensure our members have the best possible information to make an informed and significant decision about the future of the company they own,” Brendemuhl said. “We’re confident this process and the recommendation for approval of the CHS proposal achieves those goals.”

Craig-Hallum served as a financial advisor to West Central. Advisory tax and assurance firm Baker Tilly US LLP provided tax and accounting support. Winthrop & Weinstine PA served as legal advisor.

Comments