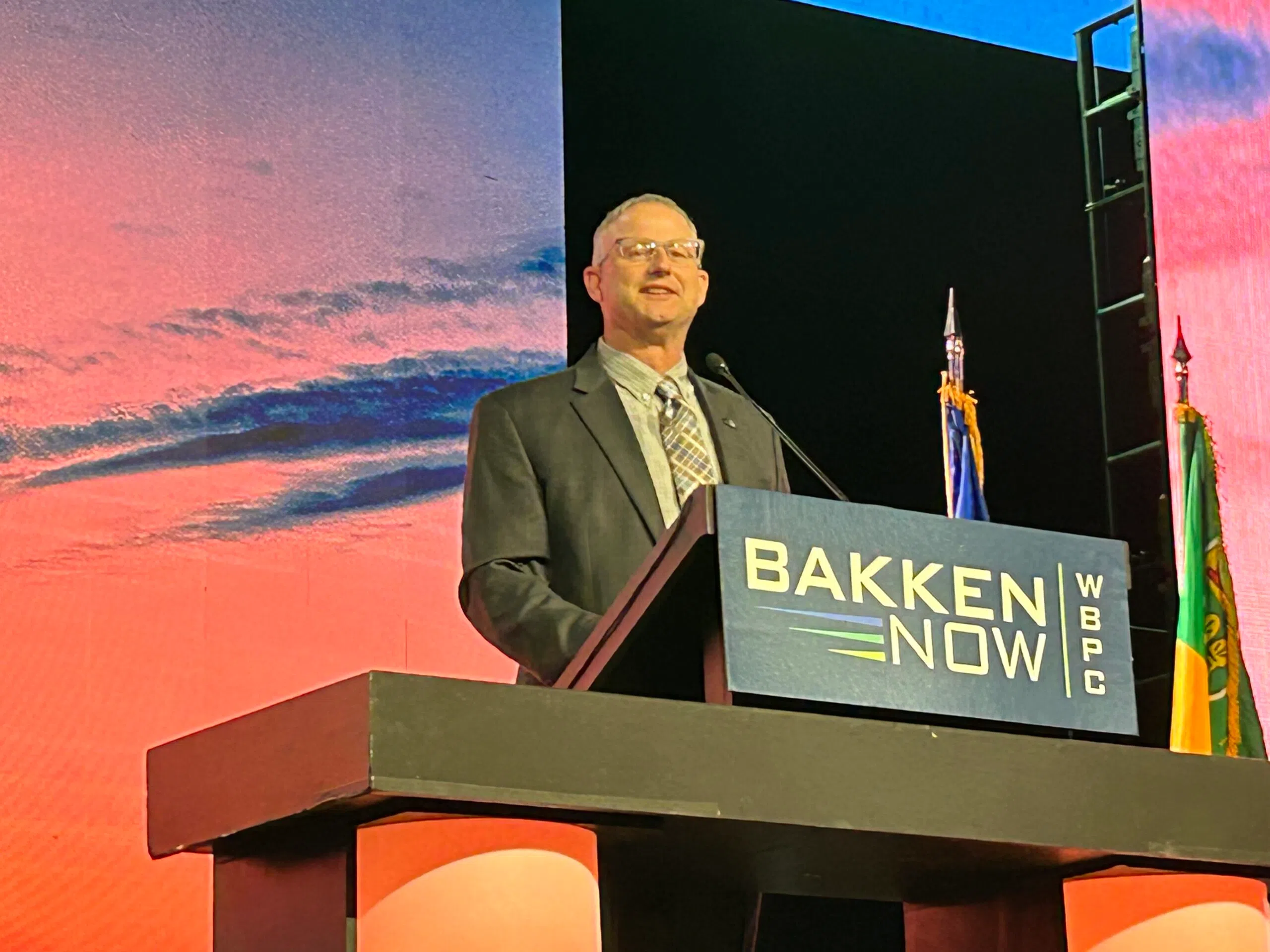

Bank of North Dakota Chief Business Development Officer Kelvin Hullet, pictured at the 2024 Williston Basin Petroleum Conference, presented a report to lawmakers Wednesday about ways North Dakota can navigate industry and government trends related to environmentally conscious investing. (Amy Dalrymple/North Dakota Monitor)

BY: MARY STEURER

BISMARCK, N.D. (North Dakota Monitor) – The Bank of North Dakota on Wednesday released a long-anticipated report analyzing how a popular investment strategy that emphasizes environmental sustainability is affecting North Dakota’s state government and economy.

The concept of using “environmental, social and governance” criteria — commonly referred to as ESG — to guide business decisions was first popularized in the 2000s by the United Nations.

Amid fears that ESG-based investing and policymaking disproportionately harms North Dakota’s energy and agriculture-dependent economy, the Legislature in 2023 passed a law asking the Bank of North Dakota to study the framework.

In testimony submitted in favor of the bill, the Western Dakota Energy Association called ESG “woke capitalism.”

The report, made public Wednesday, recommends ways for North Dakota to navigate various ESG-related political and economic forces — especially those related to the environment.

The goal is to strike a balance between supporting its agriculture and energy industries while still making North Dakota marketable to carbon-conscious investors, insurers and governments, officials who worked on the report told a panel of lawmakers in a Wednesday morning presentation.

Sen. Dale Patten, R-Watford City, said while North Dakota lawmakers may not agree with every recommendation in the report, he hopes it spurs in-depth conversation about ESG ahead of the 2025 legislative session.

“It’s the baseline from which we form the discussion,” he told the Legislature’s Energy Development and Transmission Committee during the presentation.

Recommendations in the report include:

- Budgeting more state money for fighting federal energy and agriculture regulations in court.

- Adopting statewide building code standards to make buildings safer and reduce property insurance costs.

- Creating a new state program to incentivize more effective land management and conservation of North Dakota grasslands.

- Creating a multi-state insurance pool for the coal industry.

- Creating a tax exemption for transmission line infrastructure.

- Expanding natural gas pipeline infrastructure.

The Bank of North Dakota established a 27-person committee of state government officials and industry representatives to guide the report’s development.

The bank convened eight workgroups in the areas of agriculture, carbon monetization, electrical transmission, finance, hydrocarbon, insurance, procurement, state fund investments and water. The workgroups made most of the recommendations included in the study, according to the report.

The authors of the study also conducted interviews with 80 different agencies, companies and organizations.

“This was a substantial undertaking,” Kelvin Hullet, chief business development officer for the Bank of North Dakota, said at the hearing.

The Bank of North Dakota did not budget any money for the study, according to Janel Schmitz, the Bank’s communications and marketing manager.

The report was not North Dakota’s first attempt at addressing ESG-style business practices.

In 2021, the state adopted a law forbidding the State Investment Board from investing public money solely for social reasons, unless that investment would make at least as much money as a similar investment that does not come with the same social benefits.

The 2023 Legislature expanded on this language to apply to all state agencies.

That session, in the same bill that approved the ESG study, North Dakota lawmakers also added language barring insurers from refusing coverage or charging different coverage rates to clients due to ESG criteria.

Comments