By Pablo Mayo Cerqueiro

LONDON (Reuters) – Permira is putting together a dedicated investment team to focus on the transition to a low carbon economy, the private equity group said, as alternative asset managers look to capitalise on the global shift to a greener future.

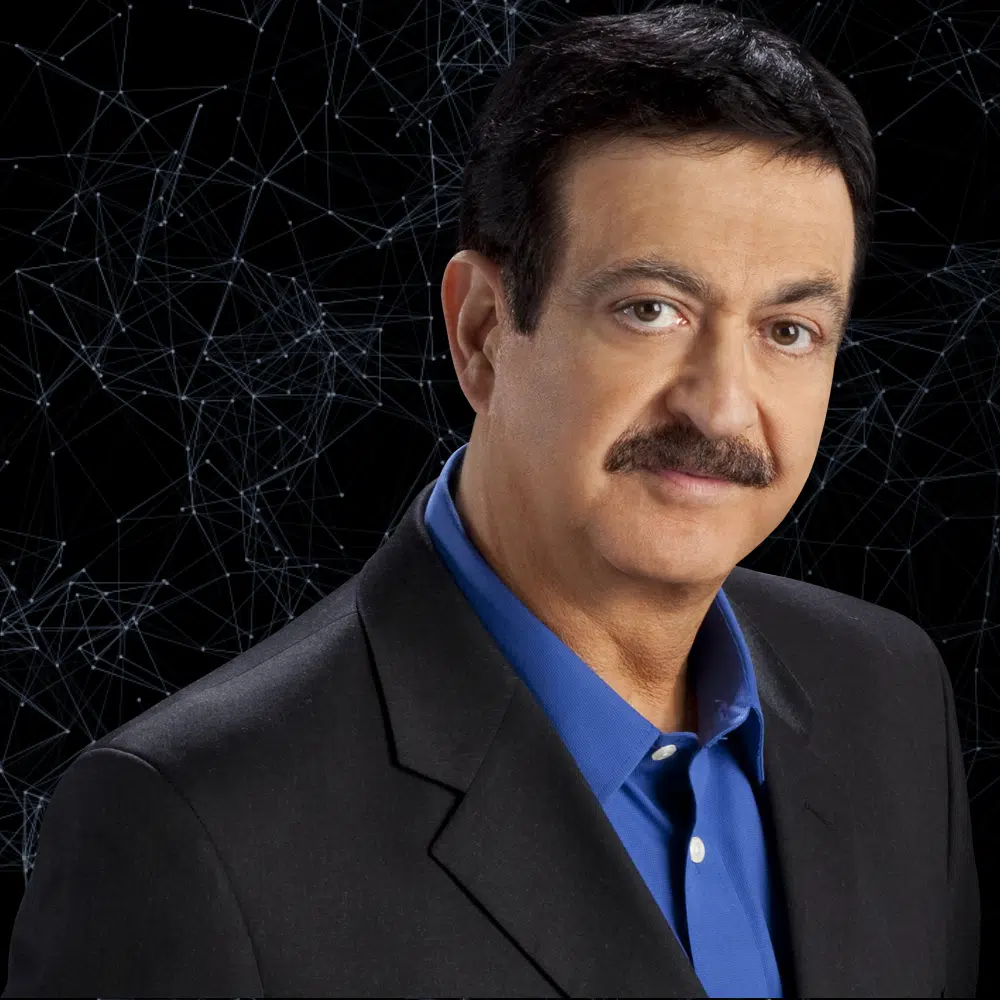

The team will be led by former Blackstone executive Kush Patel, who joined last year in New York, and a yet-to-be named hire in London.

“We believe the climate transition is an exceptional global growth opportunity and is at an inflection point … it represents a $12 trillion cumulative revenue opportunity by 2030,” Patel said in a statement.

The team will invest globally in energy transition projects and platforms, as well as related technology and services.

This includes areas such a renewable energy, the decarbonisation of so-called hard-to-abate industries, and the modernisation of energy grids.

“We have identified a need for capital to help accelerate decarbonisation in the growth and buyout portion of the market that sits between venture capital and infrastructure,” Kurt Björklund, managing partner at Permira, said.

While most climate-related investment to date has gone into renewable energy projects, policymakers are increasingly keen to ensure industries such as steel, cement, aviation and shipping get the finance they need to reduce their emissions.

Permira’s news comes just days after rival Carlyle appointed Goldman Sachs’ former head of commodities research Jeff Currie to lead its energy transition analysis.

Energy-focused buyout firm ArcLight Capital Partners in January launched a new unit to capitalise on transition opportunities, while firms including KKR and Brookfield have launched multibillion-dollar funds to profit from the move.

The need for an overhaul of much of the world’s infrastructure in the transition also underpinned BlackRock’s recent deal to buy Global Infrastructure Partners (GIP), and General Atlantic’s deal for Actis.

(Reporting by Pablo Mayo Cerqueiro. Additional reporting by Simon Jessop. Editing by Anousha Sakoui and Mark Potter)

Comments