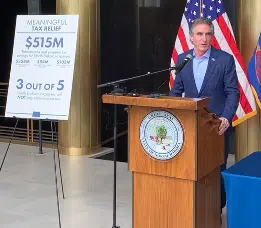

BISMARCK, N.D. (KFGO) – Gov. Doug Burgum has signed a major tax relief package that will provide a combined $515 million in savings for payers of state individual income tax and local property tax over the next two years.

Burgum signed House Bill 1158 during a ceremony at the Capitol. He was joined by Rep. Craig Headland, the bill’s prime sponsor, House Majority Leader Mike Lefor, Senate Majority Leader David Hogue, bill sponsors, and Tax Commissioner Brian Kroshus.

“This landmark bill provides the largest individual income tax relief package in state history and is a huge win for North Dakota taxpayers,” Burgum said. “House Bill 1158 allows workers across all tax brackets to keep more of their hard-earned money while also easing the property tax burden on homeowners and making homeownership more affordable for our senior citizens.”

Headland said a lot of work went into the bill and he is pleased with the final result.

“It combines $358 million in income tax relief, while also providing $156.7 million in property tax relief,” Headland said. “This is in addition to the ongoing $1.5 billion in property tax relief the state provides to local communities. All in, this results in historic tax relief for our citizens.”

Kroshus said the package is a significant win for North Dakota taxpayers.

“The greatest benefit of the plan is that it provides meaningful relief to our state’s lower-income earners and retirees on fixed incomes,” Kroshus said. “Rather than a top-down model, it begins with everyday citizens.”

$358 million will go toward individual income tax relief and zeros out the state’s bottom tax bracket. It also combines the top four brackets into two brackets with reduced tax rates.

The two middle income brackets will be taxed at 1.95%, down from 2.04% or 2.27%, and the top two brackets will be taxed at 2.5%, down from 2.64% or 2.9%.

The remaining $157 million in the package will be provided as property tax relief. $103.2 million will provide property tax credits of up to $500 for a property owner’s primary residence. $53.5 million will be provided by expanding the eligibility requirements and maximum reduction for the state’s Homestead Property Tax Credit program for homeowners 65 and older.

“While this isn’t the flat tax we originally proposed, North Dakota will still be able to claim the lowest income tax rates in the nation among states that have individual income tax, helping us to recruit and retain workers to address our workforce challenges,” Burgum said. “We’re grateful to our legislative partners whose thoughtful work allows North Dakotans to save more than half a billion dollars over the next two years and moves us further down the path toward becoming a zero income tax state.”

The House approved the bill 84-6, and the Senate passed it 45-2.

The bill also creates a Legislative Tax Relief Advisory Committee to study tax relief, including income and property tax relief, during the 2023-2025 interim. The study will include analysis of the tax relief in HB 1158 and options to implement a flat rate for individual income tax, with findings to be reported to the 2025 Legislature.

Comments